THE LISTING PROCESS

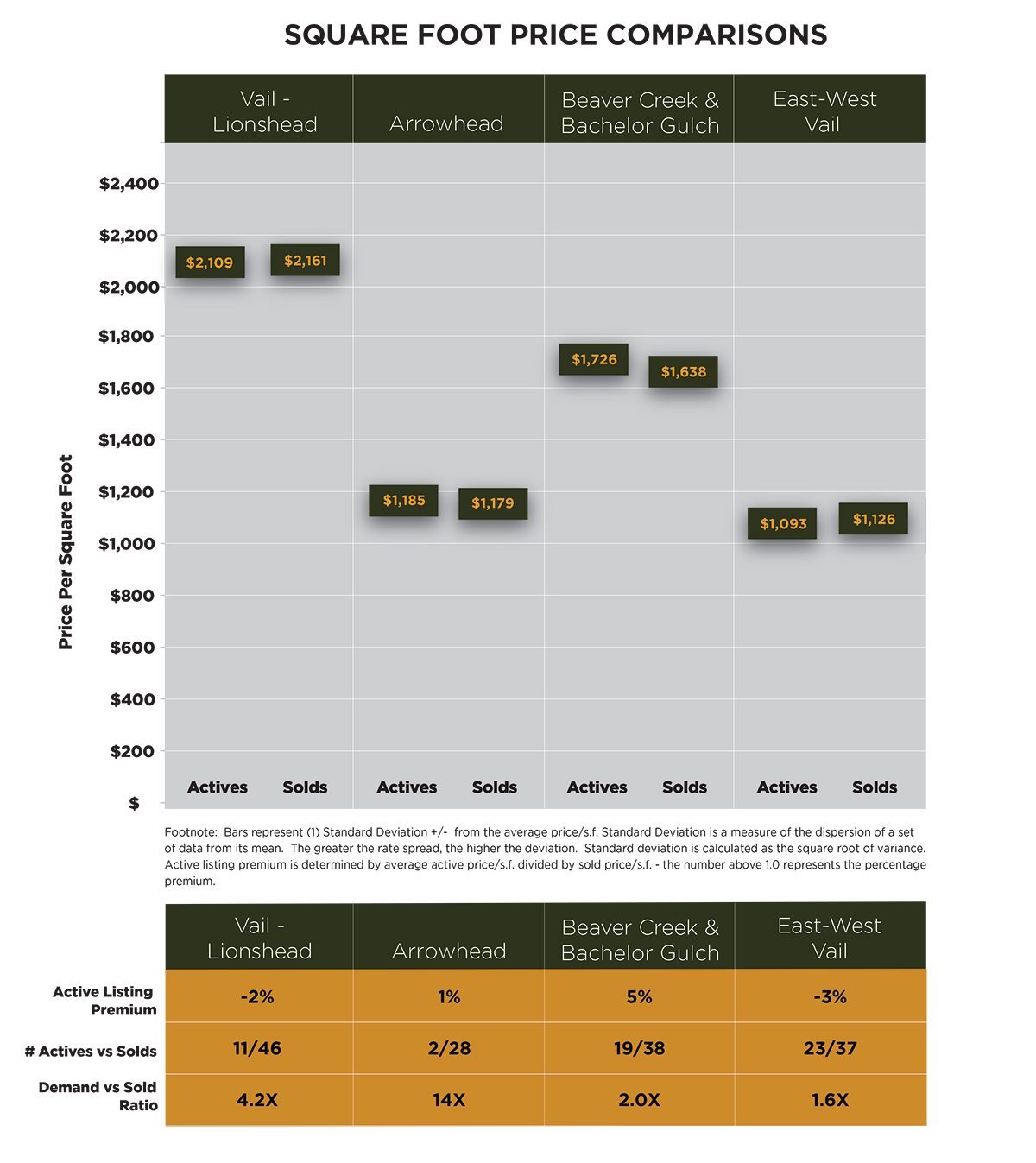

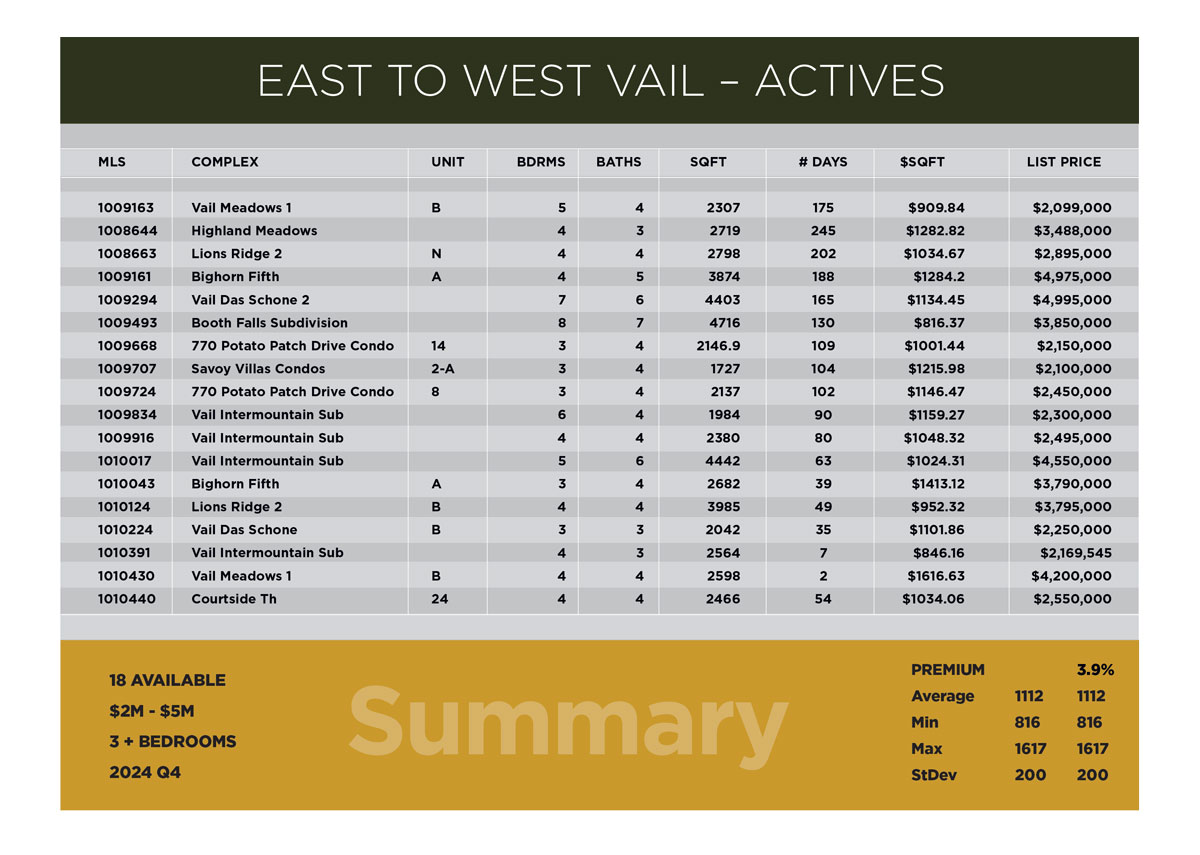

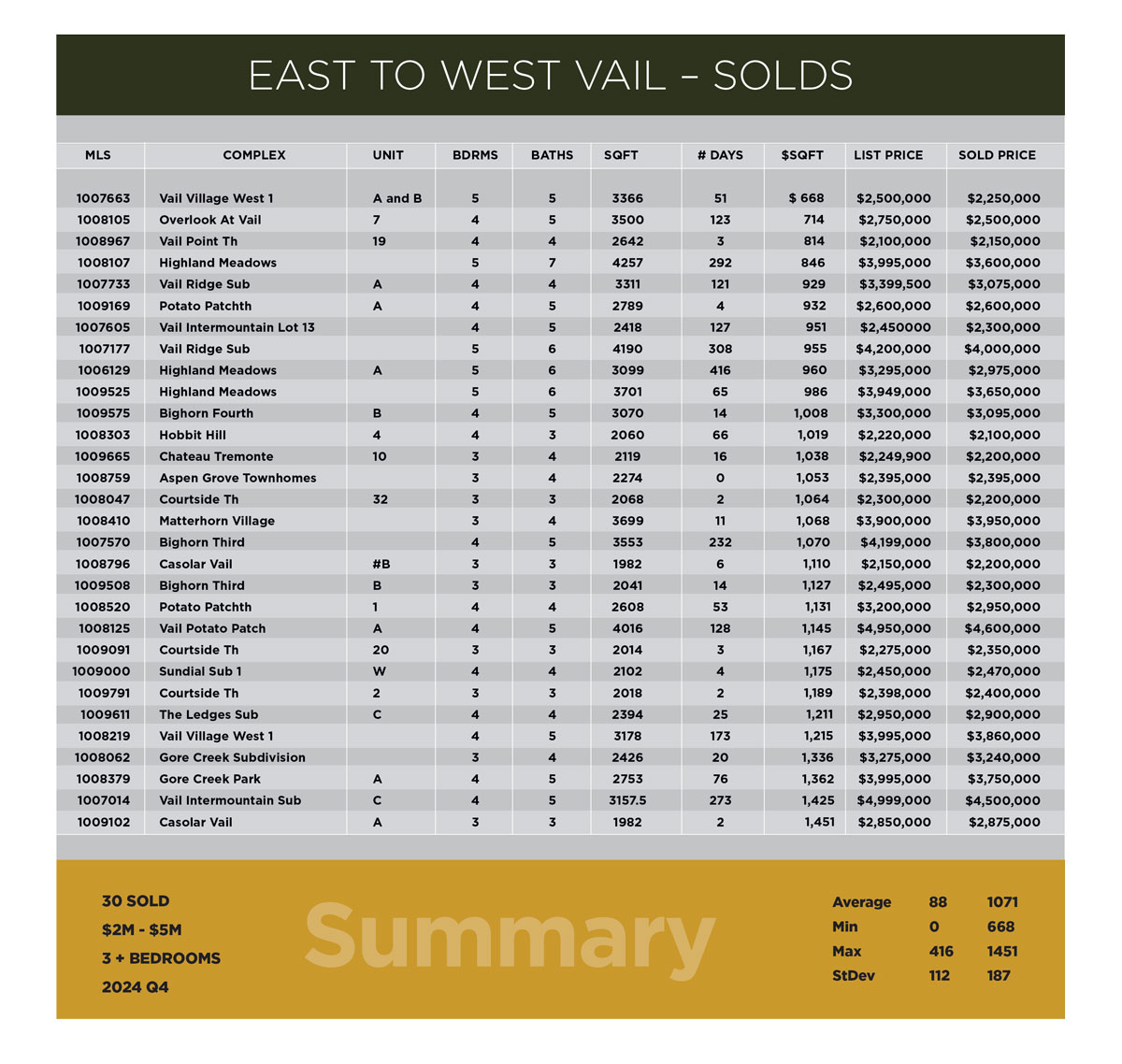

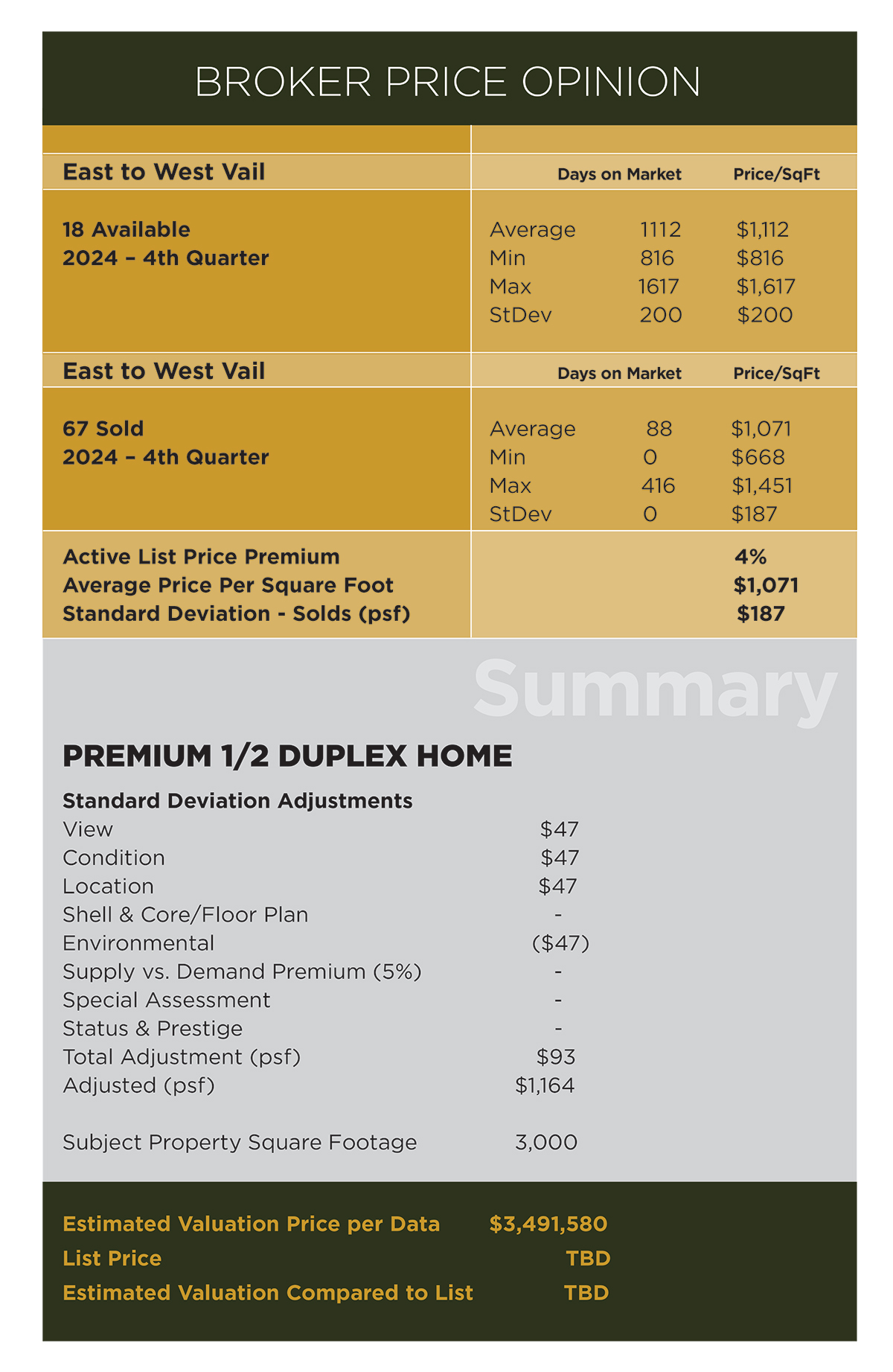

Our mission is to sell your property for the most money possible, in the shortest amount of time, with the least number of problems and hassles. Underpricing brings you less money; over pricing deters serious interest. It’s a balancing act that requires experience, comparable sold data, and an understanding of the supply vs. demand imbalances. Vail Property Brokerage understands what buyers want, their decision-making process, how to have your property stand out, and a one-of-a-kind marketing approach that will get the job done.