Vail and Beaver Creek Properties

Financial Performance

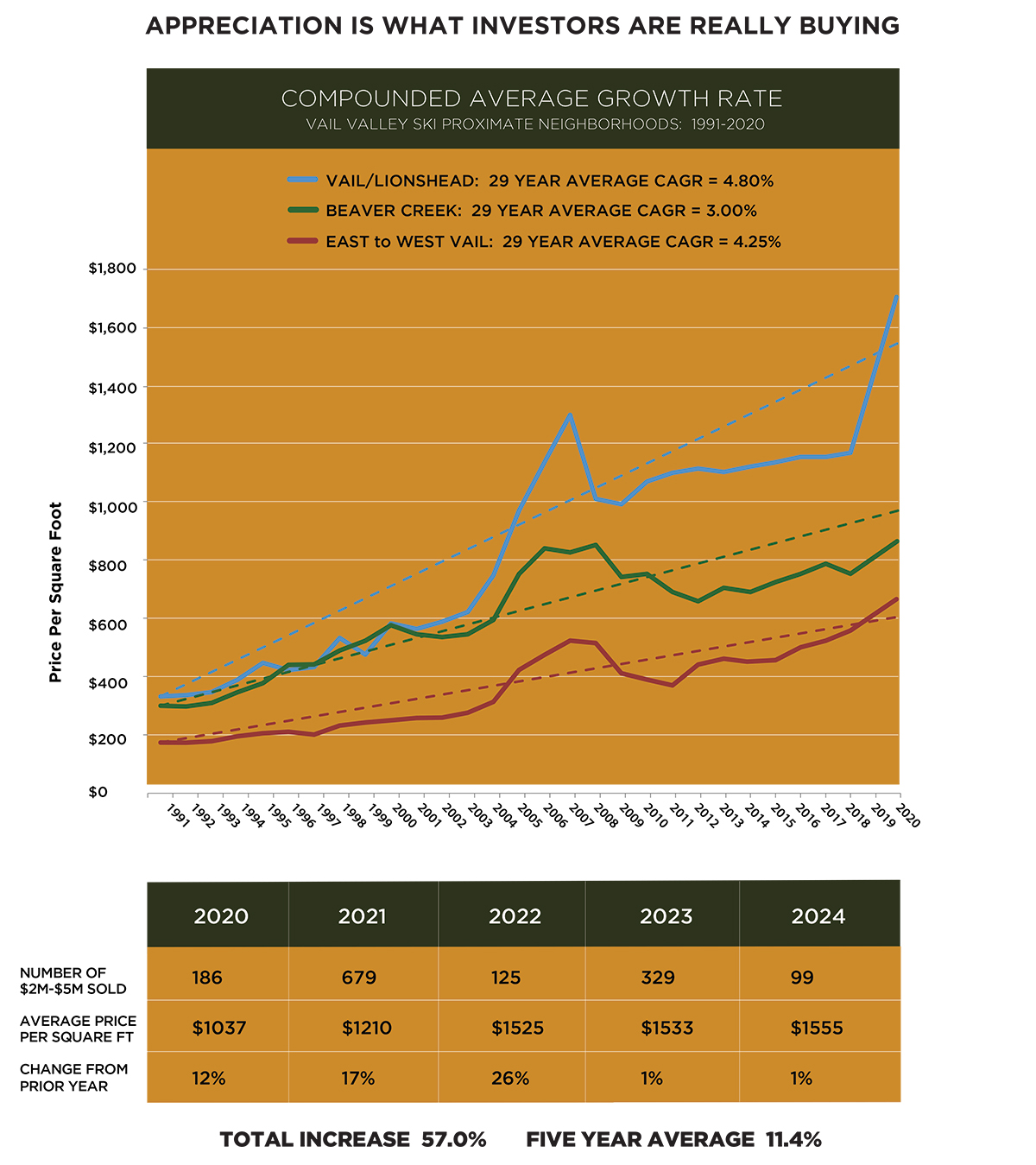

Vail has been and will always be a capital appreciation investment as illustrated by the Compounded Average Growth Rate which we expect will continue the 35 year-long 5% average going forward. This financial dividend is not so much dictated what you buy or how much is paid, but on the successes or failures of Vail & Beaver Creek as destination resorts which are proven playgrounds for the rich and not so famous. This is a complicated and detailed story so call us for more information.

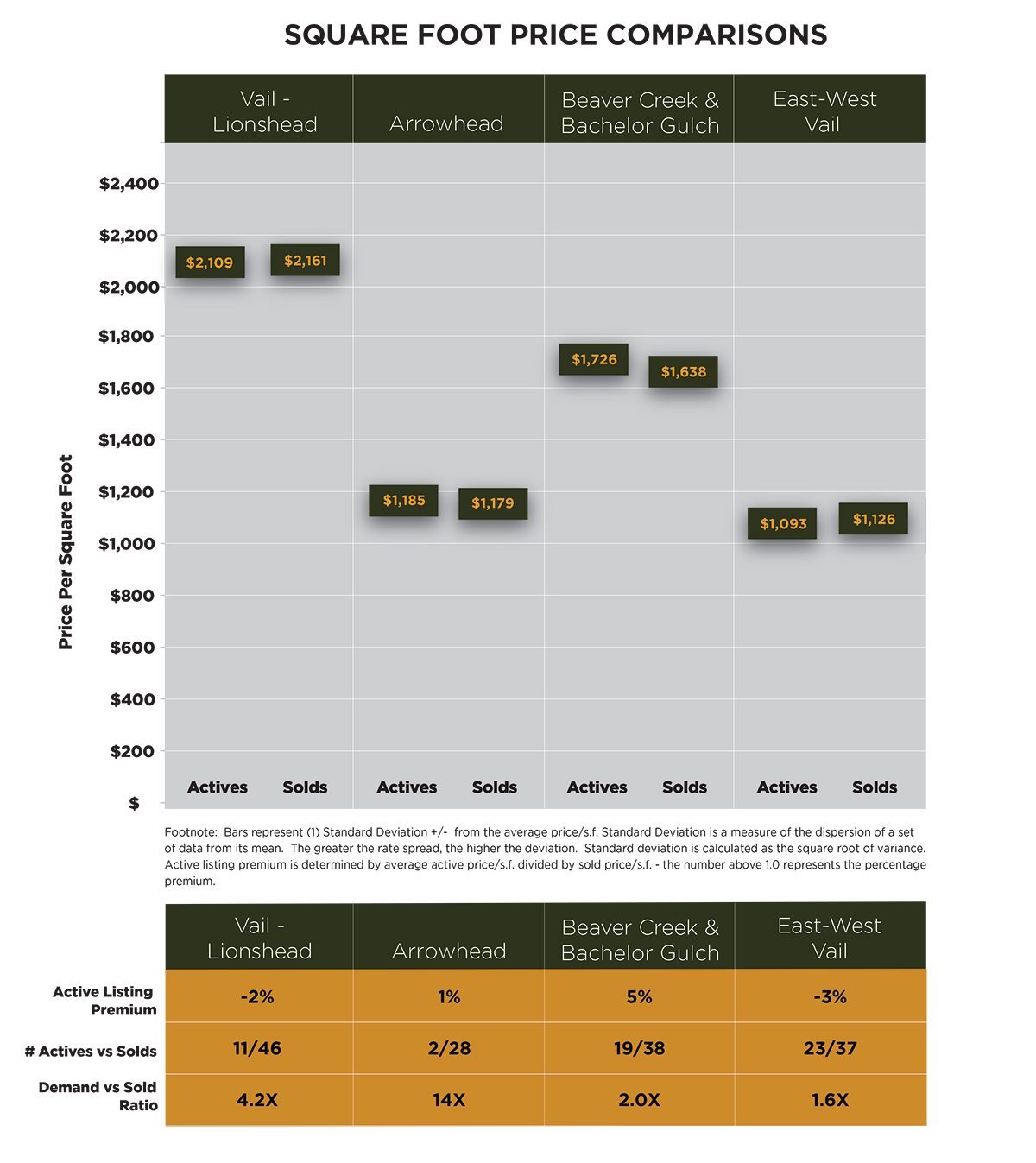

SQUARE FOOT PRICE COMPARISON

- Appreciation

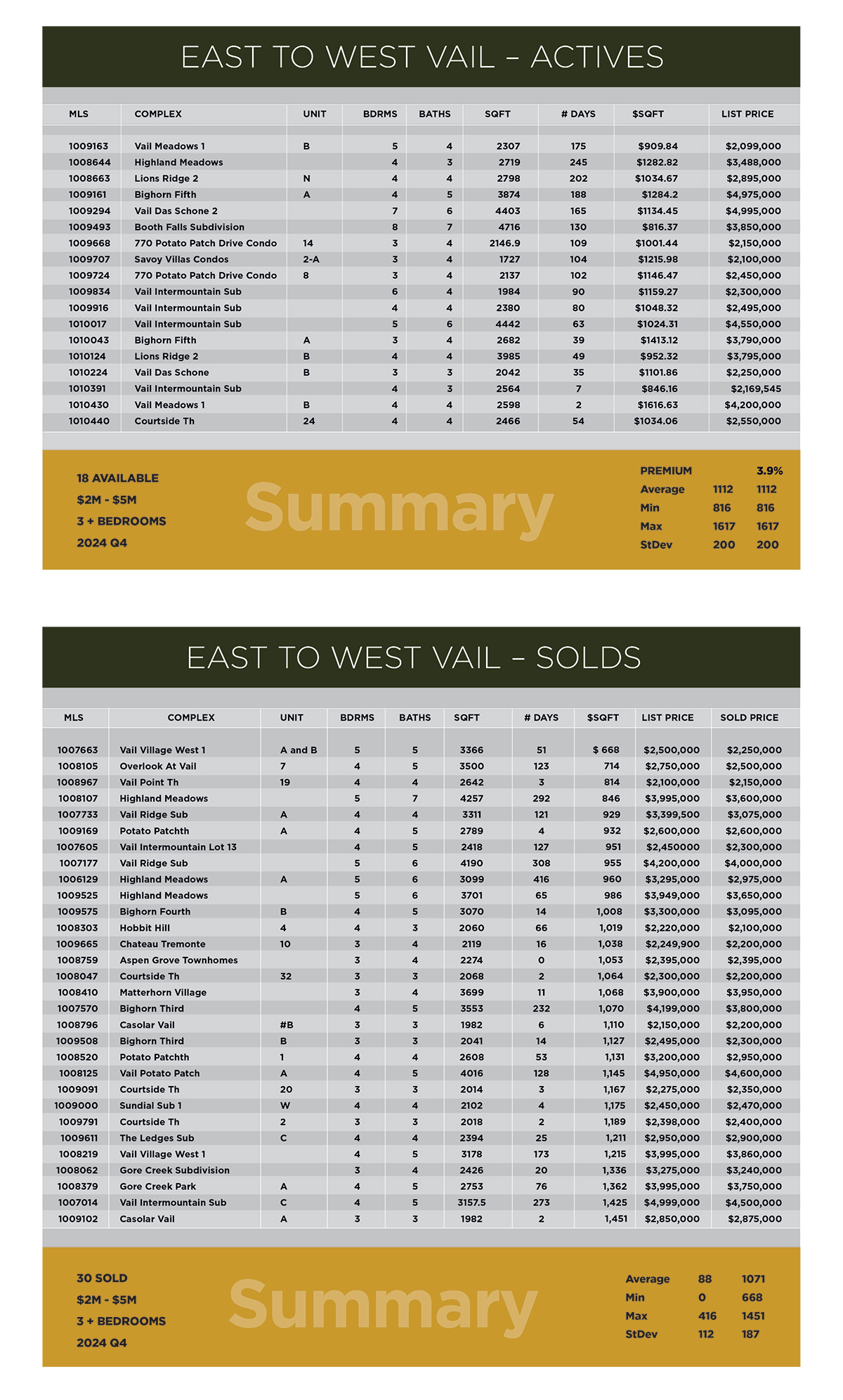

- Supply vs Demand

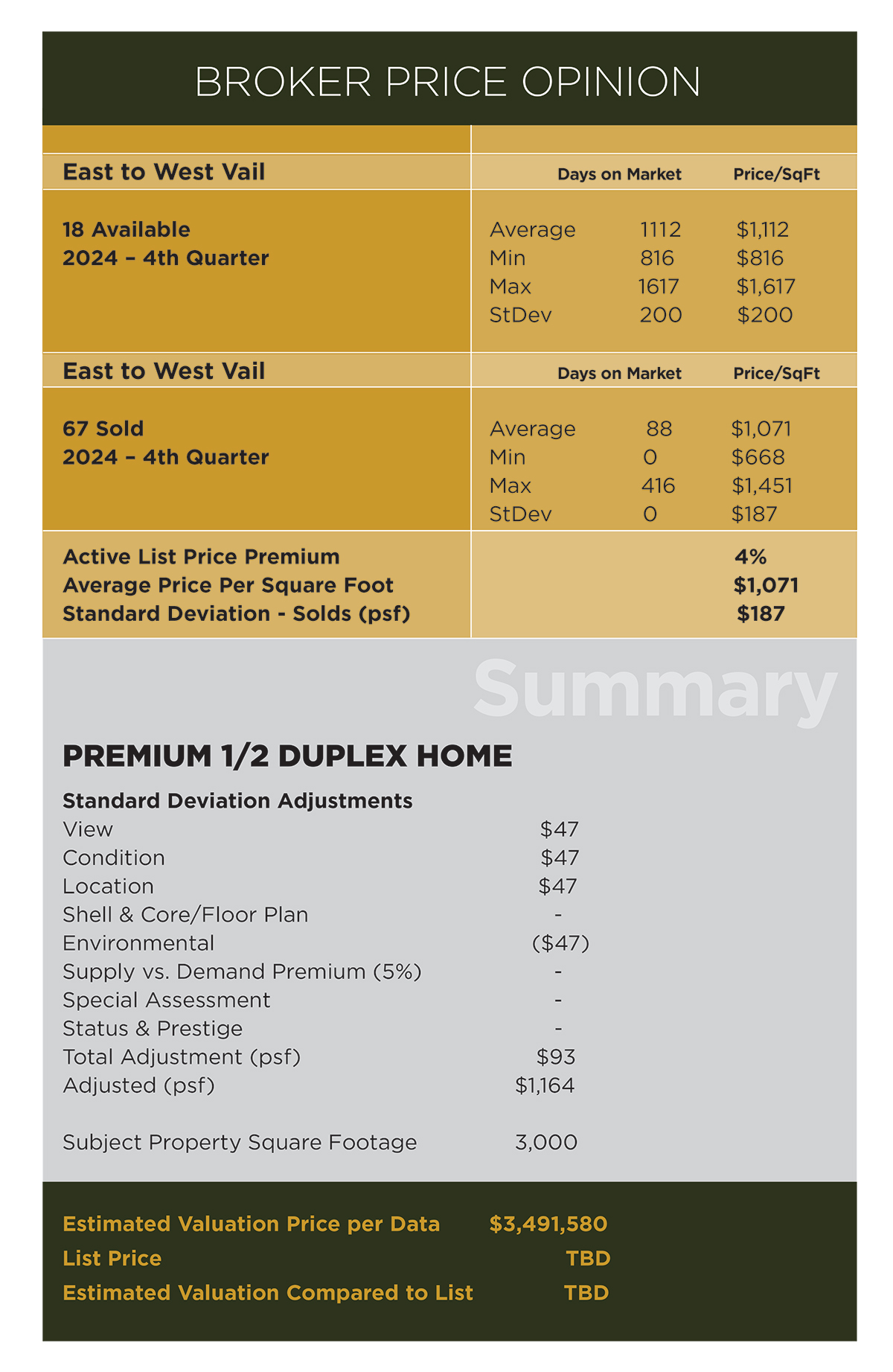

- Broker Price Opinion

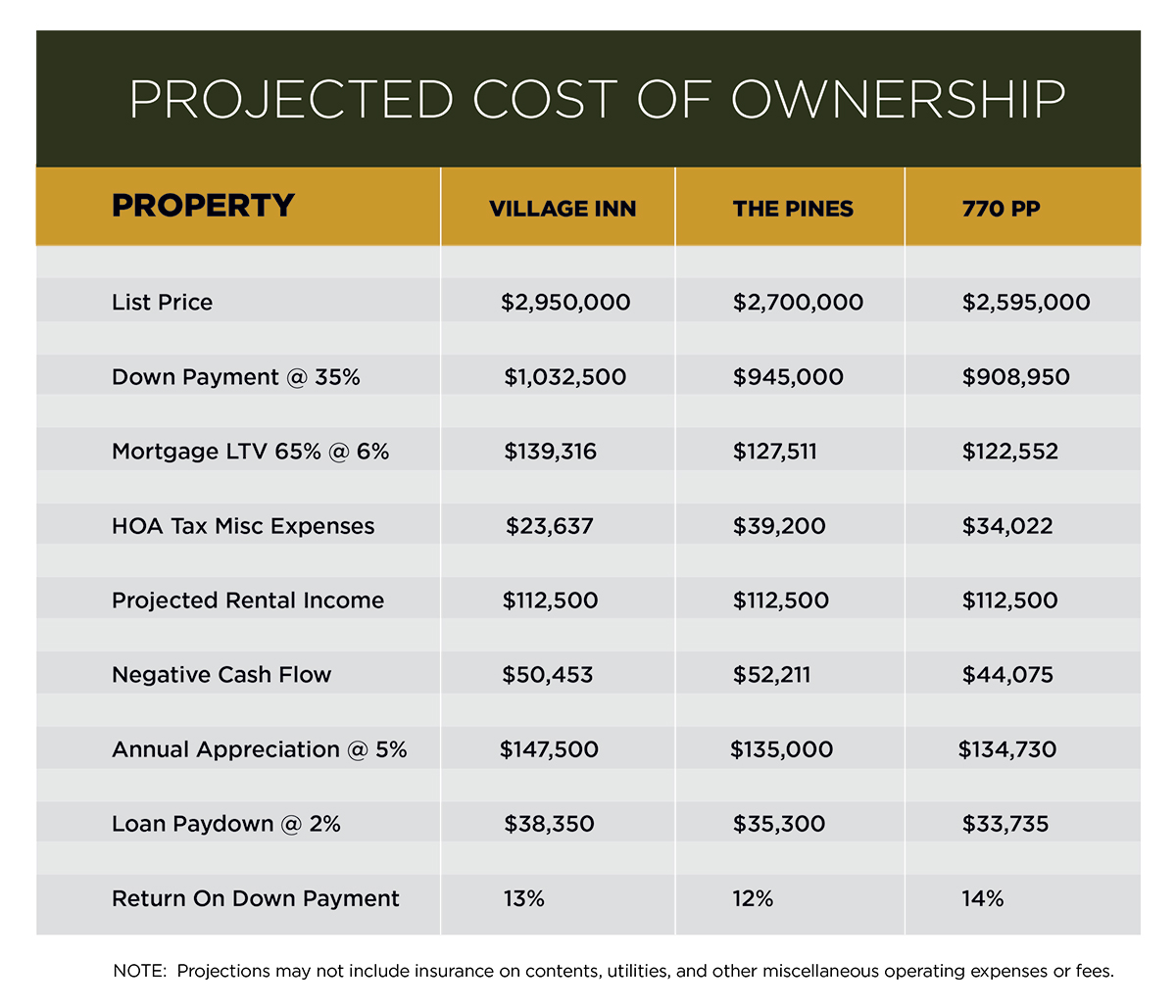

- Projected Cost of Ownership

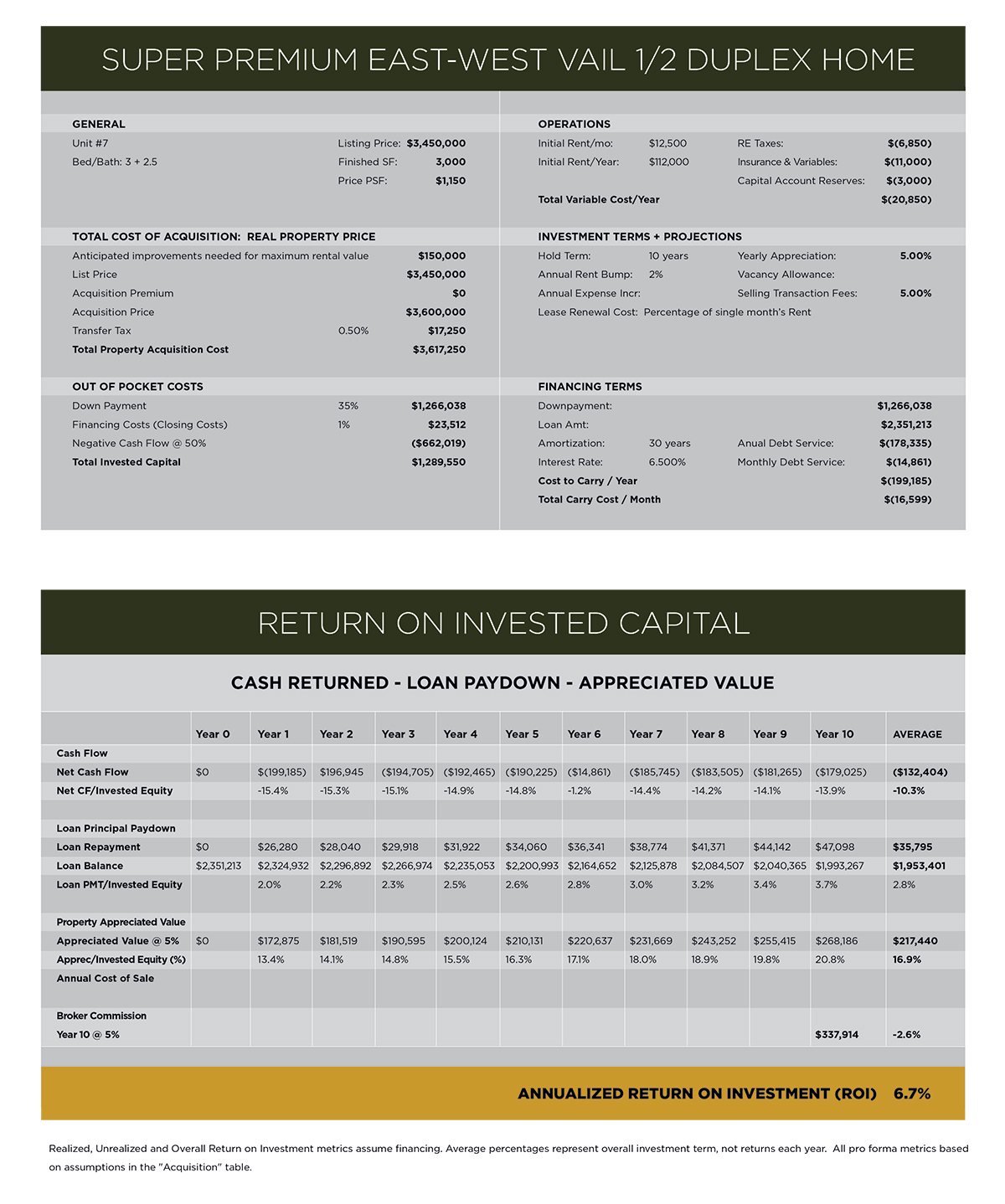

- Return On Investment workbook

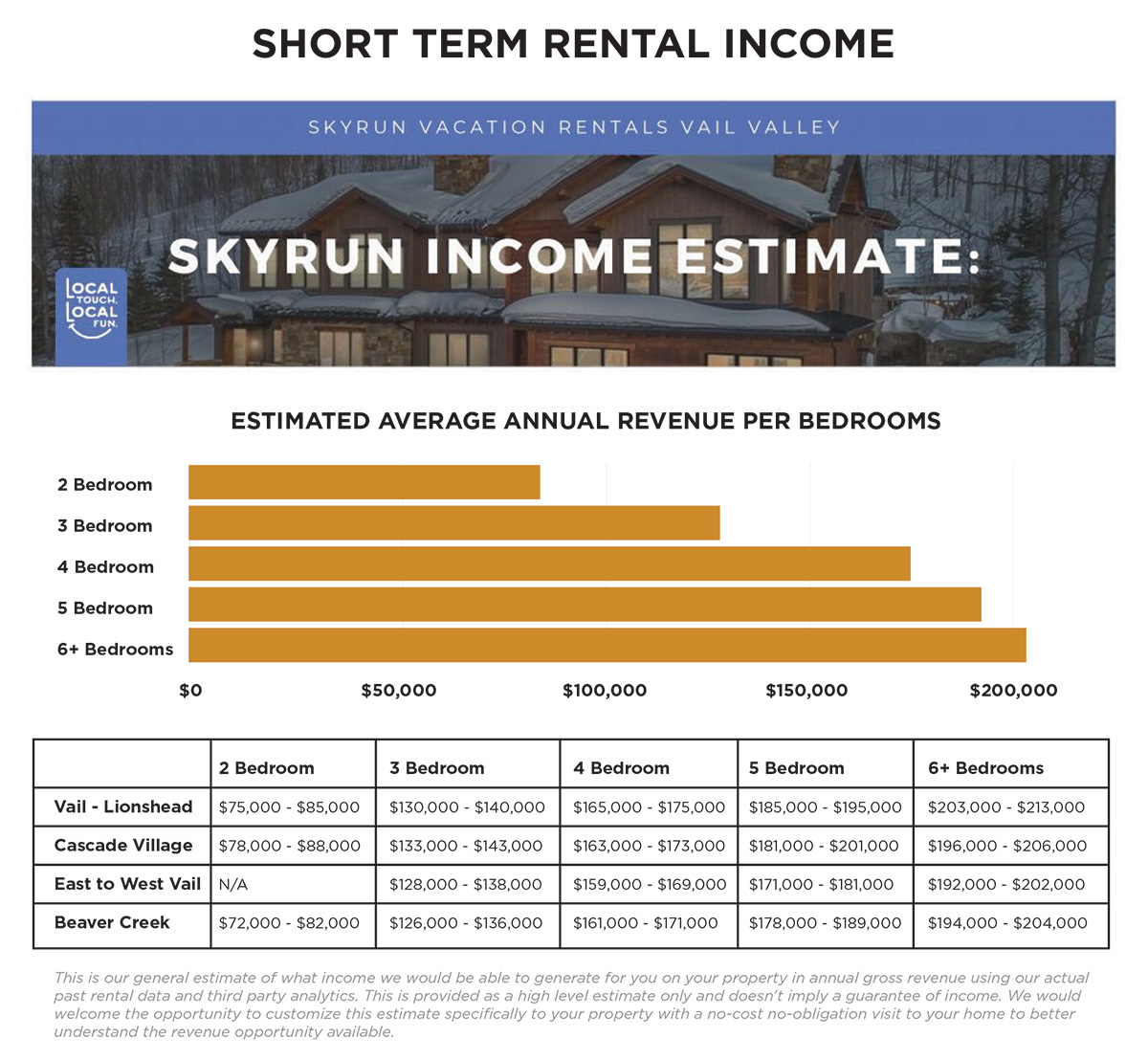

- Sky Run Short Term Rental Income narrative & income chart

- 2021 projections. Over the past 3 years these numbers have increased by more than 10%